How to manage profit with reimbursement and lump sum contracts.

Why does it matter if your project is agreed with a reimbursement contract or a lump sum contract, or, a mixture of both? All projects, regardless of the industry, are contracted slightly differently. Many of the terms and conditions, project scope, and ultimately the project outcome are similar. However, there are fundamental differences between the payment calculations and therefore the business risks.

There are of course many variations on a contract type and how they are referred to: cost-plus-incentive, guaranteed maximum price, and time and materials contracts are common. Whatever the terminology, the two broad categories for contracts are a pre-agreed payment amount (lump sum, or fixed price) and a paid-as-costs-are-incurred (reimbursement). Both reimbursement and lump sum contracts have their pros and cons for both sides of the agreement and both require the project teams to maintain tight control over their key project data to stay on top of project costs and profit.

What is a lump sum contract?

A lump sum contract is when a company or contractor agrees to deliver a scoped project for a specific, set amount. The total price of all the work, fees, and materials required to complete the project are included and are invoiced and paid as milestones are met. These progress payments are often tied to completing work packages or the percentage of work completed, but may also be set dates on a schedule.

Lump sum contracts are common and liked by project owners because the outcomes and costs are clearly defined and managed. The risk for these companies is making sure the work is delivered in line with the schedule and that the expected quality is met. They don’t have to worry about costs as they are locked in and can’t overrun.

For the contracted company providing the work, on the other hand, the risk is very much financial. Can they deliver the defined scope of work within the estimated budget and timeframe? Any additional costs and overspending on hours, equipment, or materials cuts directly into their profit. For this reason, fixed-sum contracts are used for simple projects with predictable costs. Sometimes these contracts will be incentivised with an additional fee if the work is completed ahead of schedule (cost-plus-incentive) making them more attractive to contractors.

Lump sum contracts do not guarantee profit. To mitigate this risk, build in a layer of profit that is separated from the costs of the project and is invoiced as a percentage of the total project price. This pushes the risk back to the project owner and they must ensure they maintain control of the project costs,

What is a reimbursement contract?

Reimbursement contracts are when a consultancy estimates a total cost, agreeing on a budget for the scope of work. The final invoiced amount is determined after the work is complete. Often there is a maximum budget that the consultancy agrees to, but ultimately there is more flexibility in the costs. For this reason, reimbursement contracts are used when the scope of work is not set in stone and is likely to change. These projects may be considered high risk. This is due to the uncertainty in precise scope at the outset, and variations to work packages and deliverables are expected.

Accurate data is essential whatever the contract. Whilst risk gets passed back and forth by the contract type, whether it is lump sum or reimbursement, it’s critical that project teams manage data accurately and in real time. This ensures that key project data is visible and controlled. Not only does this support the repayment of fees and expenses on time, but crucially it allows the consultancy to maximize its profitability and the project owner to reinforce quality as well as cost control.

When a cost reimbursable contract and a lump sum contract are combined

Closely managing project costs to maintain a healthy profit margin becomes particularly complex for consulting companies when reimbursement contracts are mixed with lump sum contracts. In an ideal world, we would all work on reimbursable projects that are invoiced and paid monthly. You work as much as the agreed scope requires, your profit margin and cash flow stay healthy, and the project is delivered on time and within budget. Ideal yes, but in reality, it often doesn’t pan out like that. Issues emerge roadblocks appear, scopes creep and changes need to be managed. Lump sum agreements quickly get mixed with reimbursable contracts and staying on top of project data becomes critical if you want the project to stay profitable.

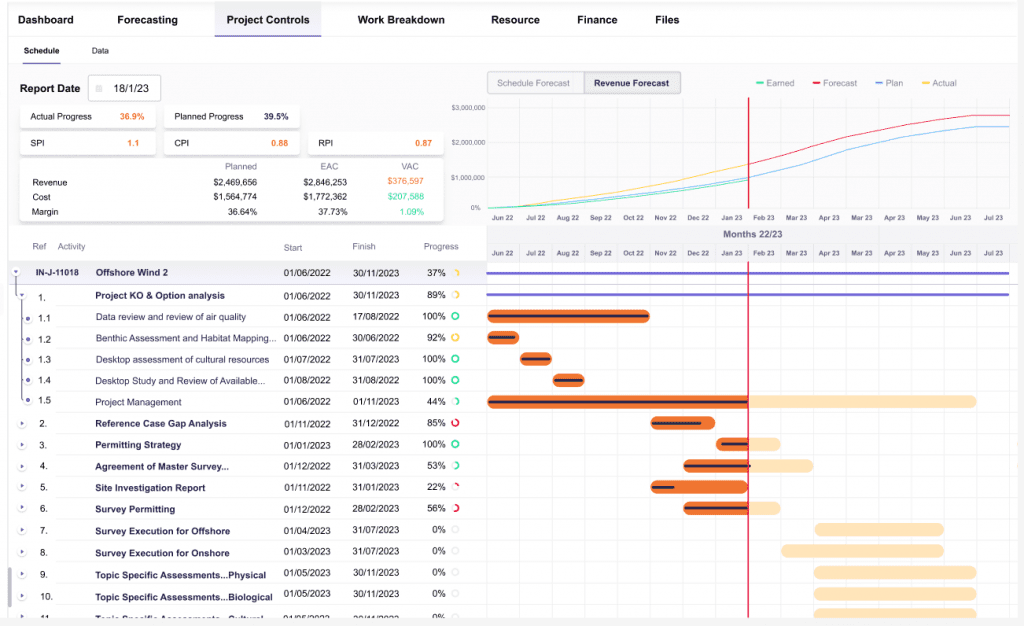

The reality is ad-hoc changes can be extremely disruptive. If a project team is not capable or prepared to be flexible, new variations can cause havoc to project margins and timelines that are set in lump sum contracts. Project management software eliminates much of this chaos. For example, Proteus manages multiple contract types automatically. With everyone using the same system, real-time data is easily accessible. And any latency that companies experience when trying to access this information is removed.

In summary, as a loose rule of thumb, if the project scope is relatively simple and clearly defined, a lump sum, fixed-price contract is more likely. The full price is set at the outset and variations can be added to facilitate scope changes. In this case, software like Proteus that automatically recalculates the margins and deploys project controls to manage performance and profit is essential to mitigate risk.

More complex projects that have tricky scopes and are riddled with uncertainty, may well use reimbursement contracts that are designed to allow for changes with the final price only agreed upon at completion. Both contract types require all the key stakeholders to monitor and track costs (both direct and indirect costs), values, and schedules in real time throughout the project.

Proteus’ project controls are designed to give you full visibility and control of your projects. All your key project data from estimated costs to forecasted performance are centralised and displayed via your project dashboards, giving you real-time insights on project performance, profit forecasts, red flags, over or under-utilisation of assets or resources, and bottlenecks. For both reimbursement and lump sum contracts, Proteus is an essential project management tool.

About Proteus

Proteus developed by a Scottish-based tech company, Xergy Group, is an end-to-end project management solution developed for the energy and engineering consulting industries.

Proteus is industry-proven and enables consultancies to meet project demands across the full lifecycle, from proposal development to project delivery. With robust sales and project delivery modules, Proteus helps its customers win more business, increase efficiencies, manage expenditures, and improve project controls.

Critical workflows, automation, and controls are integrated into Proteus. These include opportunity evaluation, proposal building, resource planning, budget tracking and forecasting, real-time multi-level restricted dashboards, and project performance analytics.

Third-party integrations and customised solutions allow Proteus’ users, which include C-suite, project leads, and engineers, to get the exact software solution needed for their business.

We offer a free onboarding consultation service to ensure your company account is set up to your company’s needs.

How to get Proteus

Proteus operates under a software-as-a-service (SaaS) model. We offer Enterprise packages and flexible pricing solutions: contact our team to learn more.

We designed Proteus to be simple, and that means you can get up and running on Proteus without an IT team or support from a programmer. You will want to spend a bit of time configuring the admin console so that you have everything set up to suit your company structure, but it’s very intuitive and you don’t need a PhD in IT.

However, we want you to get the best out of what is a brilliantly powerful tool, so don’t hesitate to ask for our support. We have a team of product experts who are ready to help you with the configuration process, so get in touch today by filling out the form below: