Gulf Intelligence 13th Global UAE Energy Forum

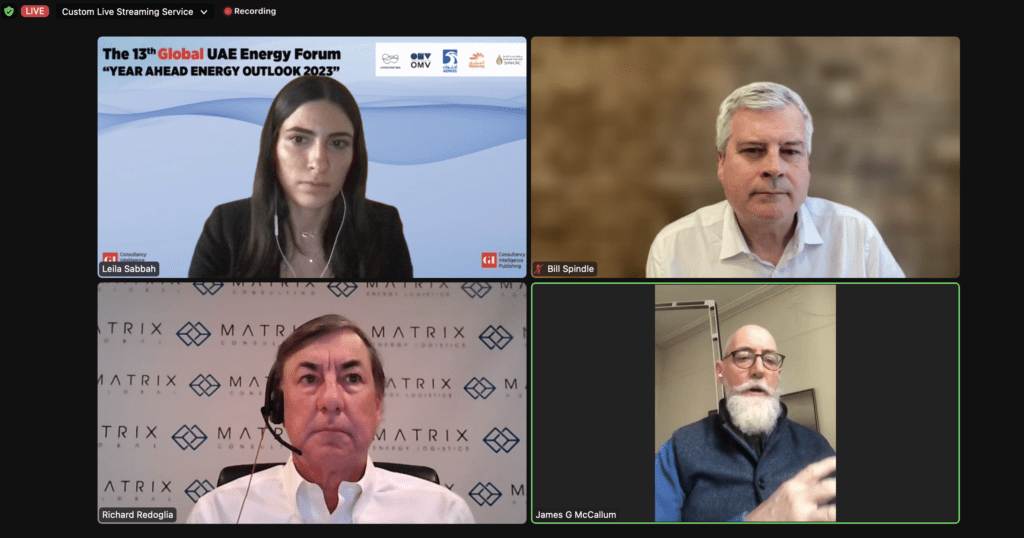

Last week I attended the Gulf Intelligence 13th Global UAE Energy Forum. I was alongside Bill Spindle, Climate and Energy Journalist, and Richard Redoglia, CEO of Matrix Global Holdings. Our topic of discussion was ‘The West: How the arm wrestle between energy security and energy transition plays out in 2023’.

Gulf Intelligence is a market leader in running online events which tackle some of the energy industry’s most pressing issues. This forum was no different. Our moderator, Leila Sabbah, posed several questions to us. Here are a few of my thoughts.

Significant global developments have changed the dialogue on LNG, and we’ve mentioned the role of oil and gas in energy transition. How can we sustain the journey towards net zero?

My fellow panellist, Richard Redoglia, discussed energy infrastructure. There is no denying that the super majors’ investment in traditional hydrocarbon production infrastructure has stalled since the downturn of 2014. One could argue there’s been a degree of fence-sitting by the boards of the major and super-major oil and gas companies. Share buybacks, dividend payments, and debt restructuring are a preferred use of capital whilst trying to determine how the energy transition agenda will play out. Global appetite from consumers and investors for the continued supply of fossil fuels will be of particular interest.

In the last twelve months, following a prolonged recession, large amounts of money have flowed into the oil and gas industry. The super majors have been recording extraordinary profits due to the impact of the Russian and Ukraine conflict and the surrounding issues. This has yet to be channelled towards replacement energy infrastructure.

One could argue there’s been a degree of fence-sitting by the boards of the major and super-major oil and gas companies

James McCallum, Chairman, Xergy

Coming back to the original premise of the question. In almost every session during the 13th Global UAE Energy Forum, there was a point where the conversation swung towards the headline energy topic – energy transition versus the security of supply. So clearly, it’s on everybody’s mind. For me, it is undoubtedly the energy issue of our time. I came into the industry in the late 70s and early 80s. This was a time when providing a secure supply of hydrocarbons to the world was seen as a catalyst for economic strength and growth. Allowing significant areas of the world to generate power and heat, contributing towards improved living standards. I came into an industry which I thought, and still believe, was groundbreaking and thought-leading.

The current energy transition situation

Today, with our appreciation of the environmental implications of uncontrolled and unmitigated carbon production untenable, the industry has the opportunity once again to be thought-leaders in energy transition, alongside continued security of energy supply. As an industry, we have lost the trust of large swathes of the public by being so late to the party. In some cases, we’ve even appeared to pursue an energy strategy seen by many to be in direct contradiction with the planet’s needs in favour of profit. Some major oil and gas companies have been represented in the media as knowingly holding back from investing in the energy transition. This is despite knowing the implication regarding continued carbon production from conventional technologies.

We have lost the trust of large swathes of the public by being so late to the party

James McCallum, Chairman, Xergy

We clearly have a challenge to win back the trust of consumers. However, if we can, we have a very exciting time ahead of us again. Once more, we will be at the epicentre of improving living conditions and, in many cases, economic poverty. Responsible energy production is not simply about hydrocarbons versus renewable energy. There’s a critical conversation to be had and actions determined on multiple topics. These include energy efficiency, decarbonisation of conventional resources, digital transformation, and efficient and effective energy project management. In my opinion, the opportunity for the industry is just as exciting as it was back in the 1970s.

We need to sustain and keep up with the implications of energy demand globally and ensure security and efficient supply from multiple sources.

We talk about CCUS (carbon capture and utilisation), hydrogen, and so many different technologies and technological advancements related to energy transition. Which one has a chance to really break through in 2023?

The offshore environment of the United Kingdom and Norwegian continental shelves is a good place to look at that in this regard. Both are part of an established and maturing hydrocarbon-producing basin with reservoirs suitable for CCUS activity. Floating offshore wind is likely to play a role in two significant areas. Firstly, the electrification and decarbonisation of production from existing production from mature assets while enabling continued carbon mitigated supply to continue. This should happen while the ownership of mature fields transitions from the super majors to independent producers.

Therefore, investment in offshore wind is essential to the move towards responsible and renewable energy production in Europe. However, installing energy infrastructure in the harsh environment of the North Sea is not without enormous challenges. Skills transition from the traditional industry will be essential, both offshore and onshore. Whilst still some way off, this will extend to the production and supply of hydrogen and will happen beyond 2023.

What we need to discuss about energy transition

If we get this right, and in my mind, this is not optional, what has yet to be understood is what will actually happen when it comes to the final investment and consenting decision points on these new capital-intensive projects.

- How will the markets and investors reward or punish companies for shifting from traditional high-margin hydrocarbon production to lower-margin renewable projects?

- How will governments convince investors that the taxation framework is stable and supportive of such investments?

- How will value be transitioned back into the developing supply chain? How will social and economic value be transitioned back into the economies and communities where these large offshore wind farms will be located?

These are critical but as yet unanswered questions. Over the next year, we will see a strong movement continuing into offshore wind. We will also likely continue to see increased research into the move towards hydrogen. Overall, it will be a transitional year in itself. There is a huge amount to play for, and the clock is ticking.

Where is the guidance on the energy transition policy going to come from?

As a direct consequence of our limited participation in the conversation on energy transition to date, we have had no alternative but to be responsive to the assertions of our politicians and social activists. In my view, with limited collaboration from the industry, there have unfortunately been questionable decisions made across multiple areas. Whilst not specifically to do with energy transition, there is a precedent of collaboration leading to energy investment previously set in the North Sea basin. As we entered the new millennium, oil prices dropped off a cliff to $12 a barrel. The North Sea’s very existence as a major source of hydrocarbon energy production was threatened. Then and now UK Government relied heavily on taxes from the oil and gas industry to underpin the UK economy.

At the time, all parts of the energy supply chain, including the government, were heavily invested in the pressing need to find an answer to the challenge that threatened the industry’s very survival in the North Sea. At the instigation of the then Labour government, a task force called ‘Pilot’ was formed, including leaders from the service sector, the offshore support sector, the oil and gas operators, and the government, including the Treasury. All sides worked together over three years to find collective answers and solutions. Multiple subgroups addressed specific short-term actions to be taken, as well as some very big decisions on licensing, taxation, and investment.

These changes drove the diversification of the operator base to include smaller independents, which drove the investor base from around 12 energy producers to approximately 70 today. This increase in investment secured the sector’s survival. It drove employment security, continued government tax revenue, and the diversification of the supply chain, particularly concerning skills.

What we need today

We desperately need this kind of collaboration now. I wholeheartedly support the point made by my fellow panellists. It is neither acceptable nor workable that our industry leaders adopt the lifetime practice of keeping our governments at arm’s length. We need to get into the room, we need to participate, and we need to lead in the agenda-setting and delivery of energy transition. If we do not, then, as in previous decades, we can have little to complain about if the industry is forced suffer from short-term decision-making made by energy populist politicians.

I wholeheartedly support the point made by my fellow panellists that it is neither acceptable nor workable that our industry leaders adopt the lifetime practice of keeping our governments at arm’s length.

James McCallum, Chairman, Xergy

There has never been a more pressing need for the collective fossil fuel industry to show responsible energy leadership in the conversation about the balance of energy security and energy transition. This is about responsibility, responsiveness, collaboration, leadership and transparency.

Where are the opportunities for energy transition?

2022 has been a remarkable year, with very sadly now almost twelve months of a war in Europe. Something we must have all thought we would not see in our lifetime. For our planet, there is perhaps only one positive outcome from this tragedy – we have become very aware of what happens when energy security, supply, and transition are thrown out of balance. I hope this is a once-in-a-lifetime moment where public awareness around the importance of energy diversity to the stability of our lives is self-evident and cannot be left solely to chance as to where we get it or from which sources.

Looking back to COP26 in Glasgow, 2021, you would be forgiven for thinking there wasn’t such a thing called an ‘oil and gas industry’ both in the lead-up to, during, and after the event. The headlines and news stories were dominated by the need to shut down fossil fuel production, coal production, and so on, irrespective of the consequences.

In 2022, the pendulum sadly swung the other way due to the war in Ukraine. This left many governments focused on immediate alternative sources of energy to counter the impact of sanctioned Russian gas.

Looking to energy transition in 2023

Across the world in 2022, we faced rampant inflation, massive cost escalation, and economic disruption. Net zero carbon production went almost unmentioned as governments focussed on the cost of living crisis. In 2023, as inflation begins to be controlled, we have the opportunity to realise that we cannot deliver a cohesive energy strategy in isolation.

As an industry, we must reject once and for all the siloed approach to transparency and inclusion, which for three decades has left us isolated and mistrusted. We must get our best minds around the table and address our reticence to collaborate once and for all.

With COP 28 being held in the United Arab Emirates, we have what may be the most crucial opportunity ever for the energy industry and world governments – to use the events of 2022 as a clarion call for collaboration. To work together in unison to secure and agree on the pathway to energy security, economic stability, and an energy transition strategy that unites us all and just might lead to a solution that collectively enables us to save our world.

About Proteus

Proteus developed by a Scottish-based tech company, Xergy Group, is an end-to-end project management solution developed for the energy and engineering consulting industries.

Proteus is industry-proven and enables consultancies to meet project demands across the full lifecycle, from proposal development to project delivery. With robust sales and project delivery modules, Proteus helps its customers win more business, increase efficiencies, manage expenditures, and improve project controls.

Critical workflows, automation, and controls are integrated into Proteus. These include opportunity evaluation, proposal building, resource planning, budget tracking and forecasting, real-time multi-level restricted dashboards, and project performance analytics.

Third-party integrations and customised solutions allow Proteus’ users, which include C-suite, project leads, and engineers, to get the exact software solution needed for their business.

We offer a free onboarding consultation service to ensure your company account is set up to your company’s needs.

How to get Proteus

Proteus operates under a software-as-a-service (SaaS) model. We offer Enterprise packages and flexible pricing solutions: contact our team to learn more.

We designed Proteus to be simple, and that means you can get up and running on Proteus without an IT team or support from a programmer. You will want to spend a bit of time configuring the admin console so that you have everything set up to suit your company structure, but it’s very intuitive and you don’t need a PhD in IT.

However, we want you to get the best out of what is a brilliantly powerful tool, so don’t hesitate to ask for our support. We have a team of product experts who are ready to help you with the configuration process, so get in touch today by filling out the form below: